End of Debt, Start of Controversy

Having not been required to pay on their loans since the early months of 2020, many student loan borrowers now find themselves reaping the benefits of up to $20,000 of debt relief. Some feel this can be unfair. The working adults who are taking on multiple jobs to pay off their debt, or the high school student, preparing their savings accounts for future student loans.

With the flick of a pen, President Biden directed the U.S. Department of Education to expunge up to $20,000 of public student loan debt for millions of borrowers. Most recipients will see relief of up to $10,000 – those with Pell Grants will enjoy the greatest of the plan.

However, opinions are mixed when it comes to forgoing hundreds of billions of dollars of student loan debt. For many older generations, they tend to find the idea unfair to those who worked multiple jobs to pay off their debt, while younger borrowers argue the cost of education has soared so high, no working class citizen can seem to find the ability to make payments on their loans.

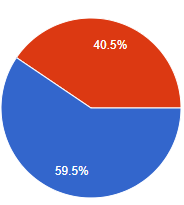

In a recent survey by The Outlander, 29% of Woodgrove teachers have been personally impacted by Biden’s new plan. Despite this minority, the survey yields that nearly 60% of Woodgrove faculty approve of measures taken to forgive student debt. Nonetheless, it appears there is a wide consensus of concern that it will set a poor example for future borrowers; 43.5% of teachers claim this as their biggest concern.

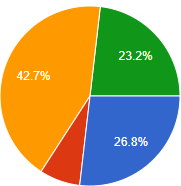

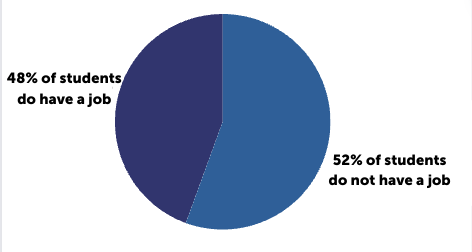

For Woodgrove teachers, 97.3% would like to see the cost of higher education and student loans reformed. The news is picking up steam among students as well. The Outlander surveyed 82 randomly selected Wolverines, and thanks to social media living at the fingertips of all youth, nearly two-thirds of participants were familiar with President Biden’s Executive action, and more than 26% of students are worried about being able to afford post secondary education.

Mr. Pyle, a Special Education teacher at Woodgrove, took a keen interest in student debt. He says, “I have two children that have attended college and incurred debt. My wife and I are doing our best to help our children as much as we can. We don’t want our children to get buried in debt.”

Mr. Pyle continues to state, “Reforming the cost of higher education is vital to the health of our country and our economy. All citizens, including people who do not plan on pursuing higher education for themselves or their children, need to demand answers from our elected leaders about why it now costs 2 to 3 times as much in inflation adjusted dollars for a college education and insist on plans to bring down the costs.”

Your donation will support the student journalists of Woodgrove High School. Your contribution will allow us to purchase equipment, attend conferences, and cover our annual printing and website hosting costs.